leverage trading crypto exchanges gemini active trader on mobile

Bexplus Exchange Gives You 10 BTC to Try 100x ţÇÇLeverageţÇü BTC ...

1600 x 871

Does Lower ţÇÇLeverageţÇü Make Better Sense for Your ţÇÇTradingţÇü?

1600 x 900

How to send ţÇÇLeverageţÇü tokens from Binance to FTX ...

2240 x 1260

How ţÇÇLeverageţÇü Can Help With Bitcoin's Price Discovery

1500 x 870

ţÇÇCryptoţÇü ţÇÇExchangesţÇü - USA friendly ţÇÇcryptoţÇü ţÇÇexchangesţÇü - Buy and ...

1603 x 859

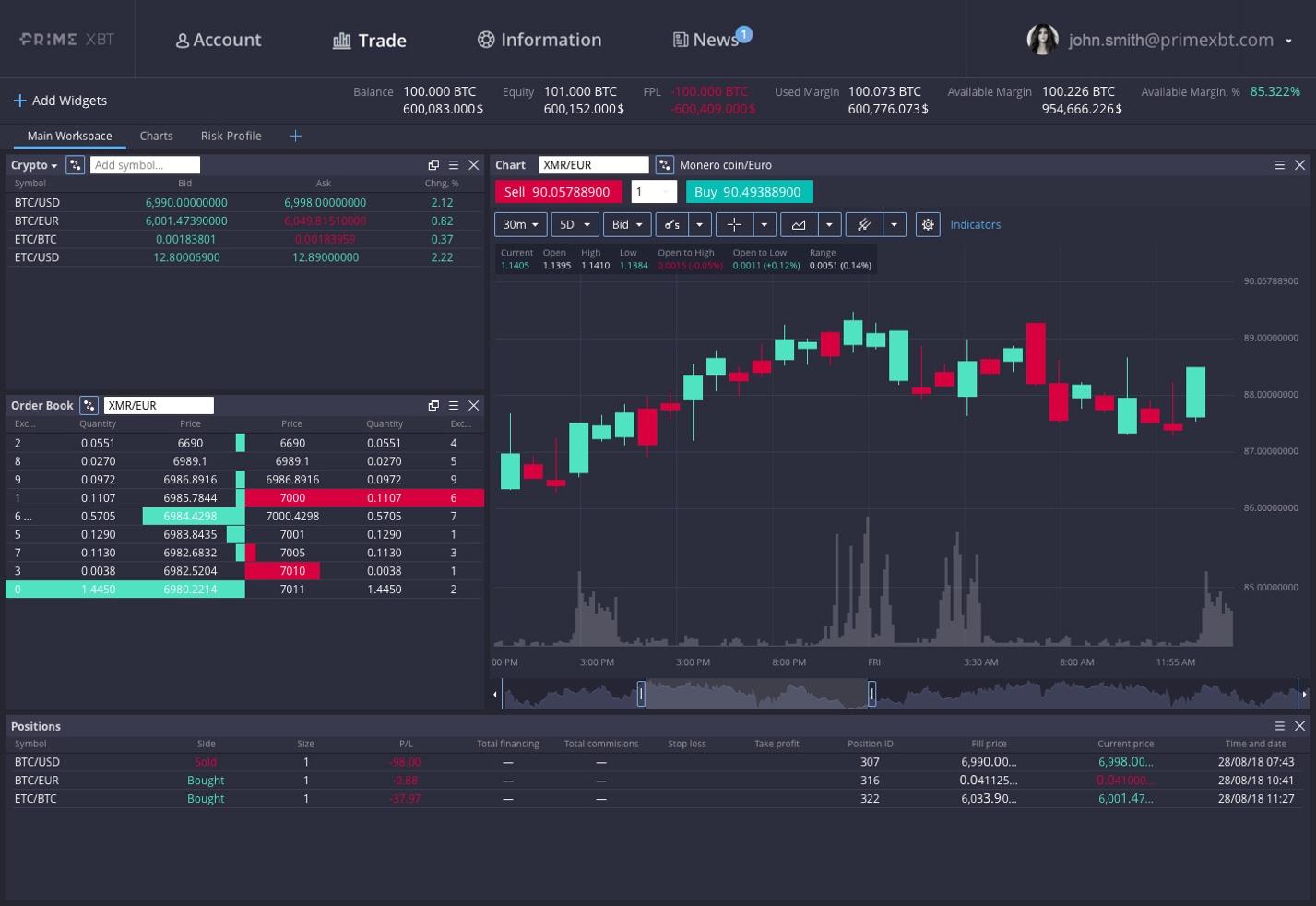

PrimeXBT: enjoy up to 100x ţÇÇleverageţÇü with the liquidity of ...

1427 x 982

Prime XBT Review 2021 - Safe Place to Margin Trade ţÇÇCryptoţÇü?

1300 x 866

StormGain Review 2020: Leveraged ţÇÇCryptoţÇü ţÇÇTradingţÇü - Is it Safe?

1400 x 933

Why Institutions will not use Centralized Cryptocurrency ...

1600 x 1131

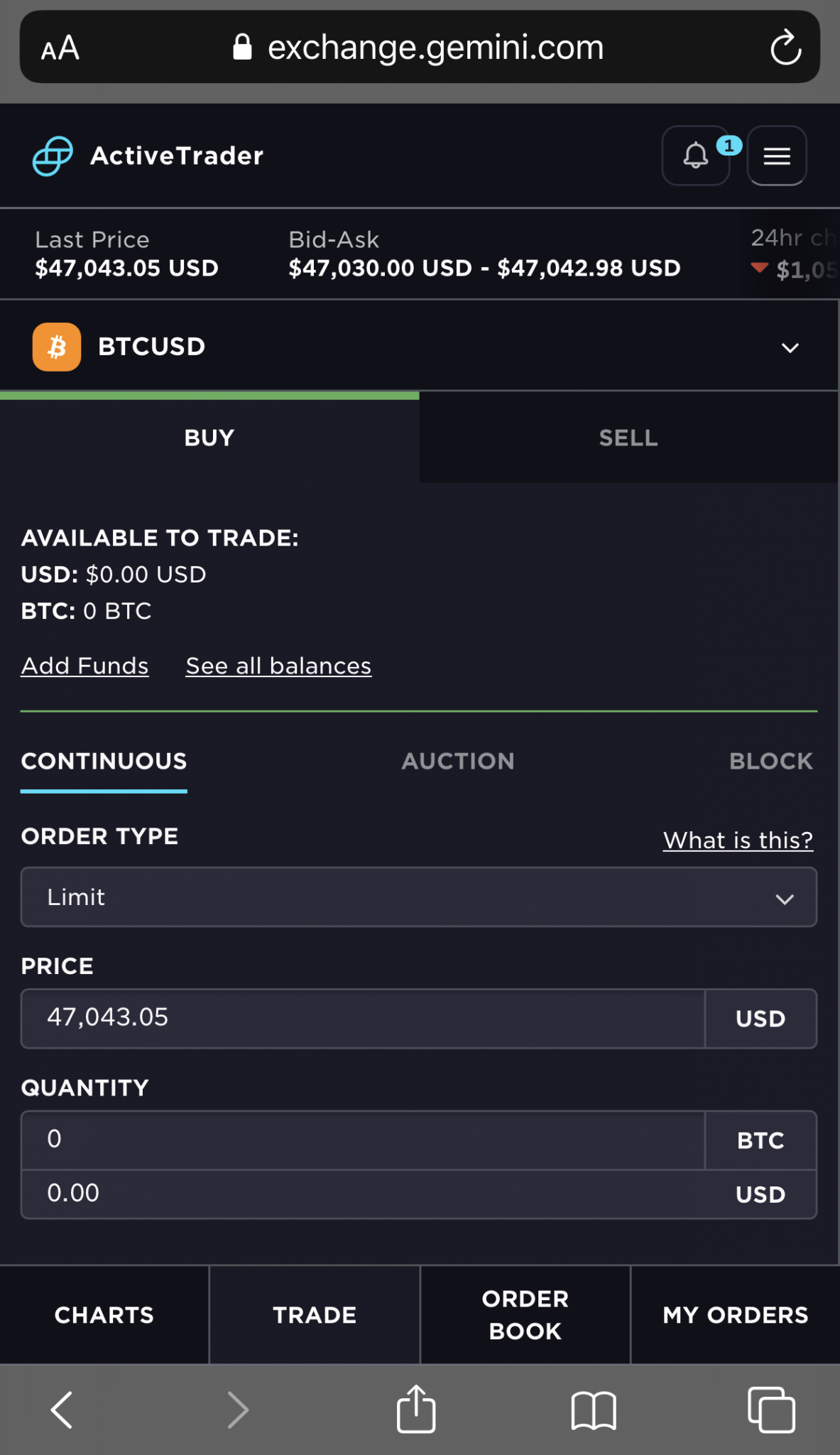

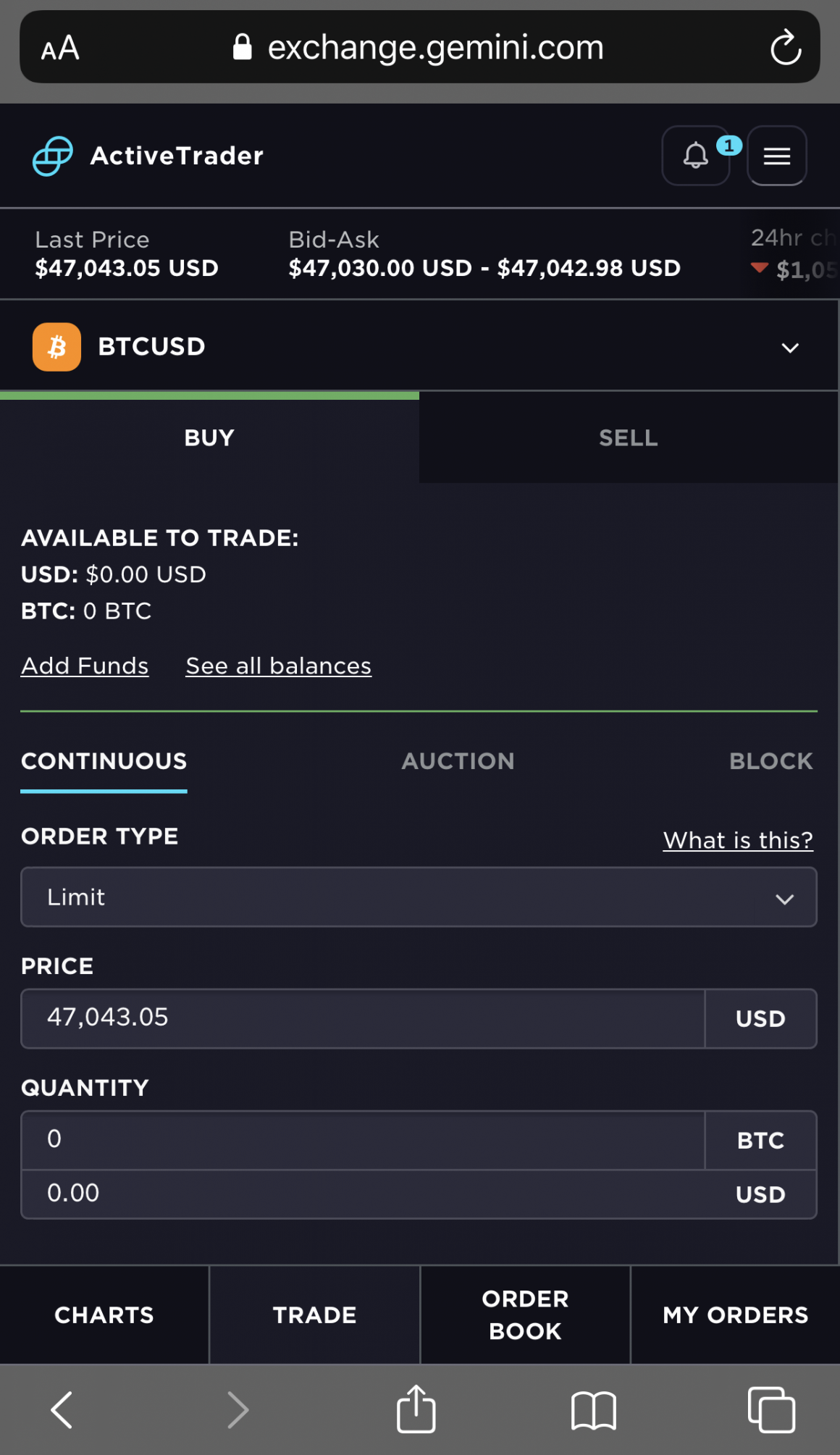

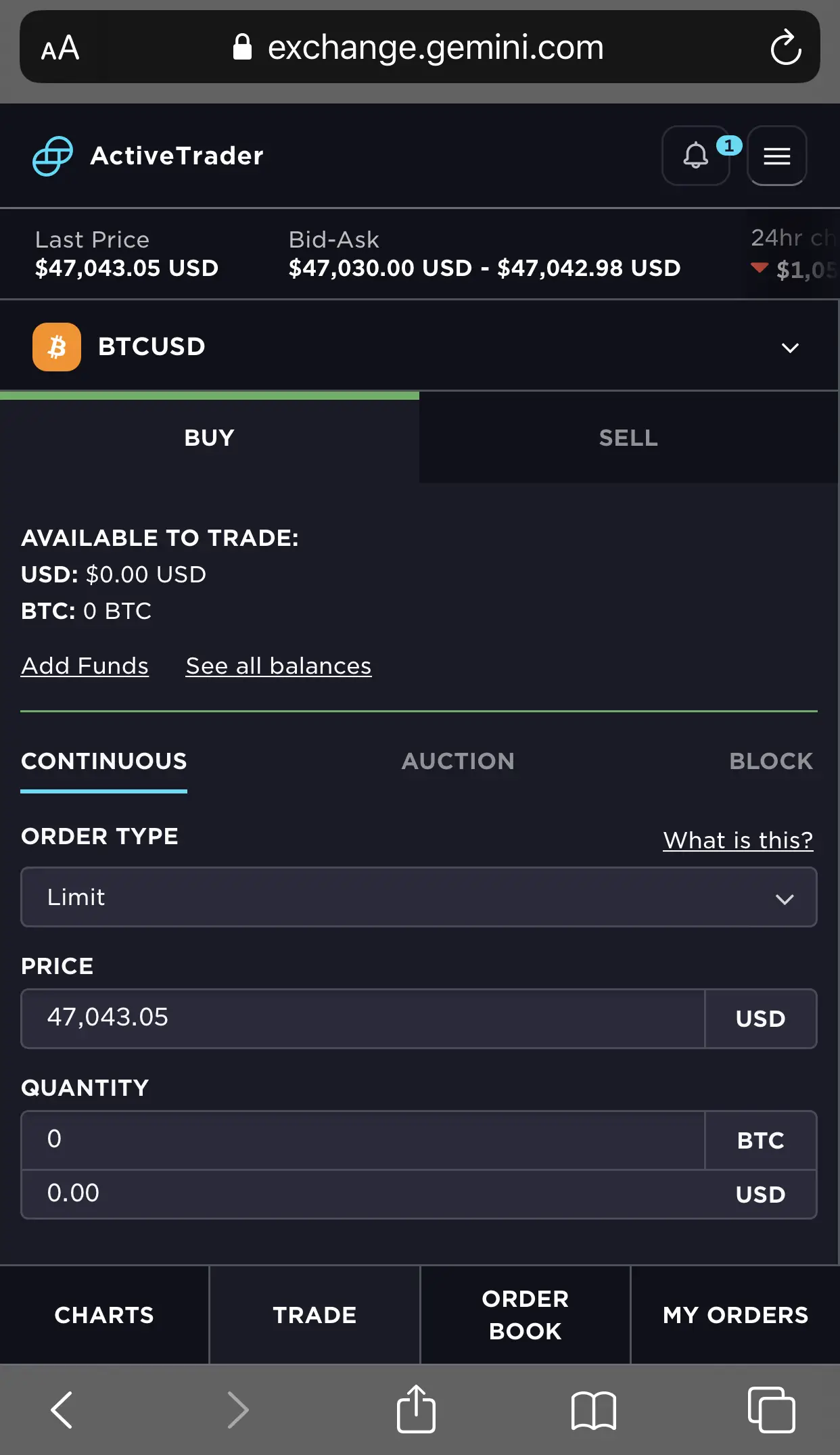

The Ultimate Guide To ţÇÇGeminiţÇü ţÇÇActiveţÇü ţÇÇTraderţÇü (2021 ...

1183 x 2048

The Ultimate Guide To ţÇÇGeminiţÇü ţÇÇActiveţÇü ţÇÇTraderţÇü (2021 ...

1160 x 2009

The Ultimate Guide To ţÇÇGeminiţÇü ţÇÇActiveţÇü ţÇÇTraderţÇü (2021 ...

1242 x 2151

Crypto ţÇÇTradingţÇü Platform - ţÇÇGeminiţÇü ActiveTraderÔä | ţÇÇGeminiţÇü

1654 x 1022

The Ultimate Guide To ţÇÇGeminiţÇü ţÇÇActiveţÇü ţÇÇTraderţÇü (2021 ...

1189 x 2048

ţÇÇGeminiţÇü vs Coinbase: Fees, Safety & More (2021 Updated)

1917 x 857

The Ultimate Guide To ţÇÇGeminiţÇü ţÇÇActiveţÇü ţÇÇTraderţÇü (2021 ...

2048 x 944

Crypto ţÇÇTradingţÇü Platform - ţÇÇGeminiţÇü ActiveTraderÔä | ţÇÇGeminiţÇü

1768 x 1424

The Ultimate Guide To ţÇÇGeminiţÇü ţÇÇActiveţÇü ţÇÇTraderţÇü (2021 ...

1536 x 804

The Ultimate Guide To ţÇÇGeminiţÇü ţÇÇActiveţÇü ţÇÇTraderţÇü (2021 ...

1160 x 1999

ţÇÇGeminiţÇü launches a ţÇÇmobileţÇü app to buy and sell cryptocurrencies

1200 x 800

ţÇÇGeminiţÇü Crypto Deutschland ţÇÇGeminiţÇü Is A Digital Asset ...

2667 x 1500

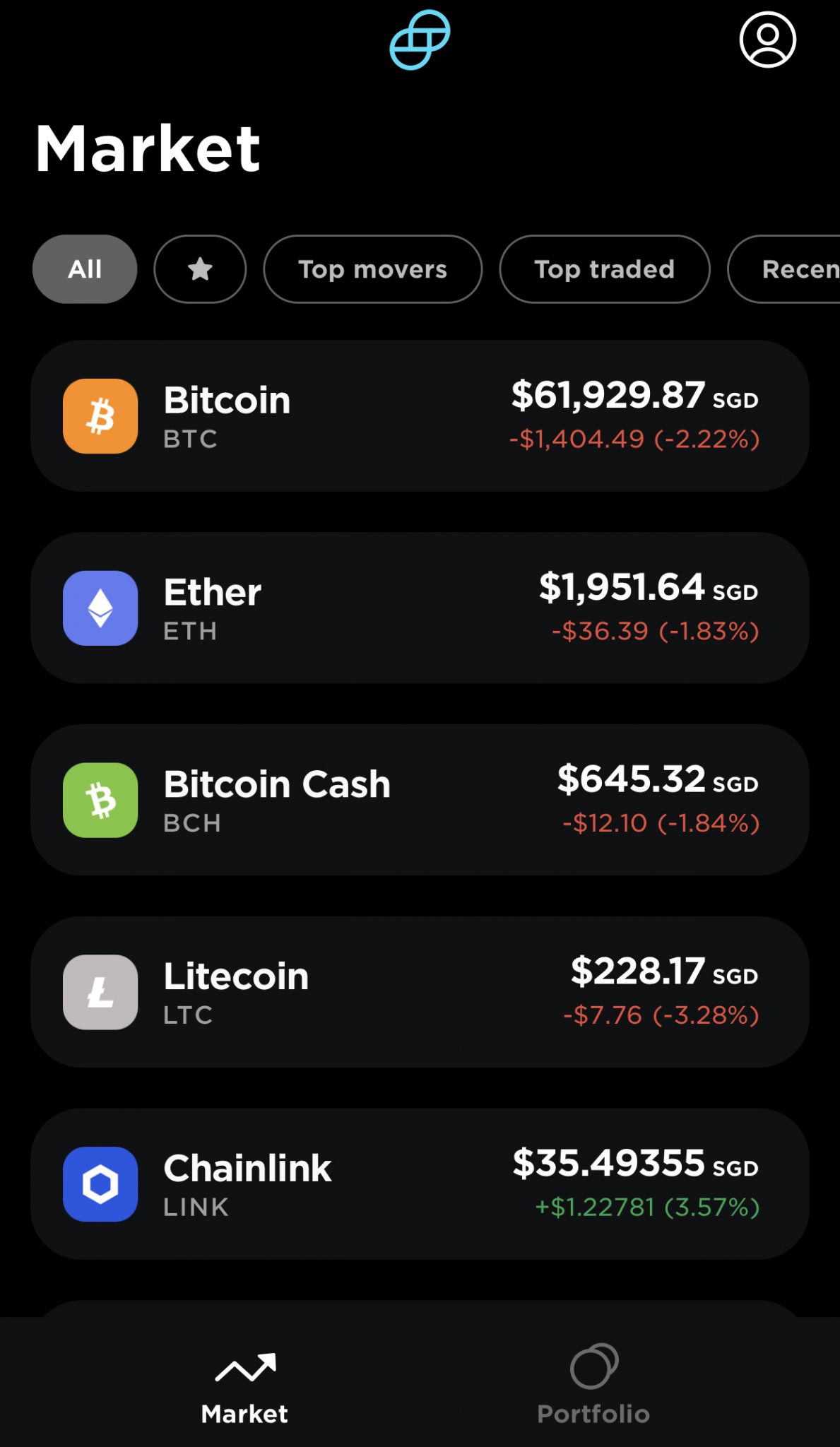

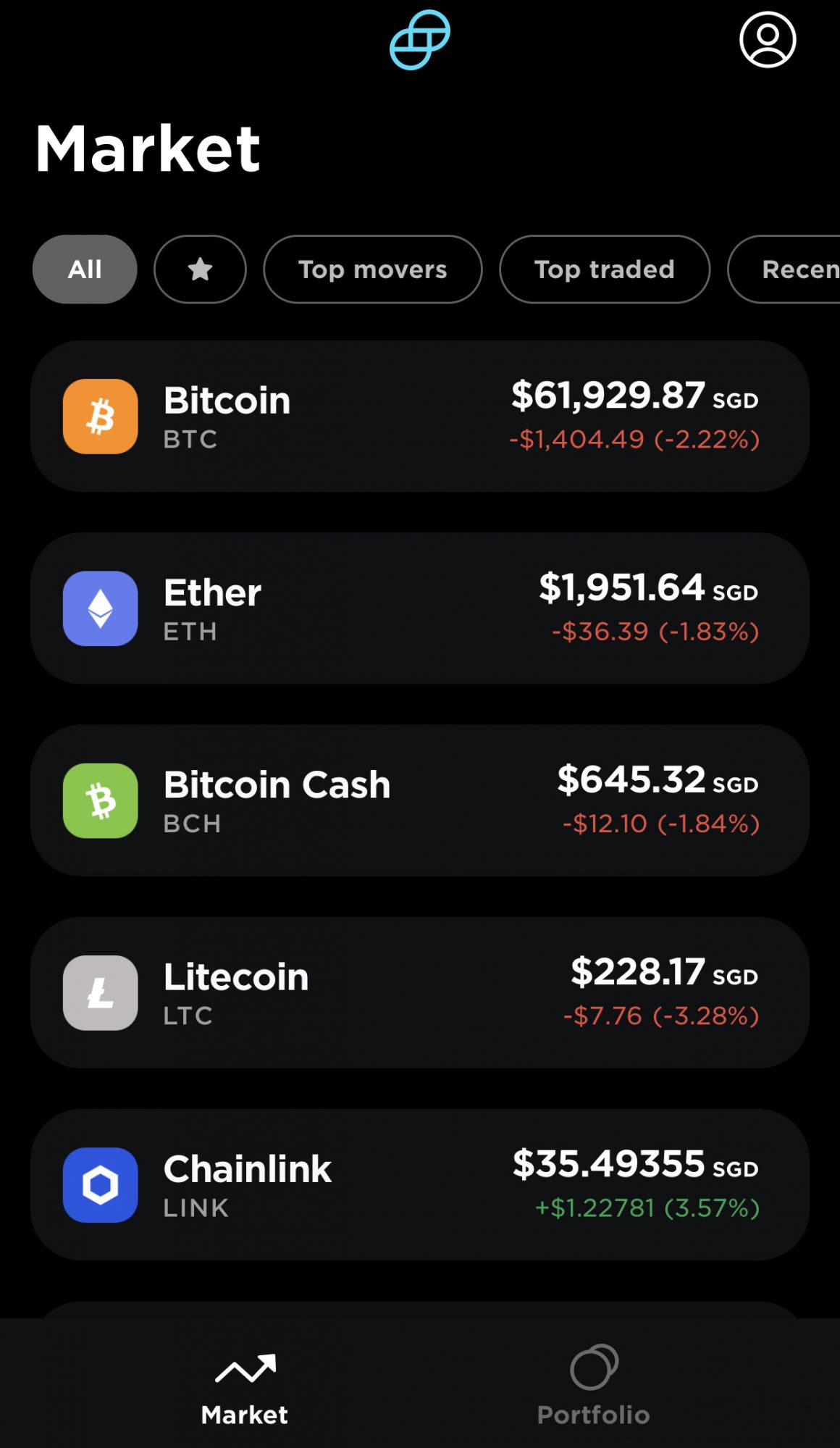

Complete Guide ÔÇô How to buy Bitcoin (or crypto) in ...

2048 x 1048

Complete Guide ÔÇô How to buy Bitcoin (or crypto) in ...

1920 x 983

Complete Guide ÔÇô How to buy Bitcoin (or crypto) in ...

1536 x 786

ţÇÇGeminiţÇü Crypto Deutschland ţÇÇGeminiţÇü Is A Digital Asset ...

2667 x 1500

Calance d'inventaire. ţÇÇGeminiţÇü tt-900 - tourne-disques avec ...

1800 x 1137

Calance d'inventaire. ţÇÇGeminiţÇü tt-900 - tourne-disques avec ...

1200 x 800

ţÇÇGeminiţÇü Now Supports Dogecoin. Much Wow. | ţÇÇGeminiţÇü

2026 x 1138

ţÇÇGeminiţÇü Crypto Deutschland ţÇÇGeminiţÇü Is A Digital Asset ...

2667 x 1500

ţÇÇGeminiţÇü Crypto Deutschland ţÇÇGeminiţÇü Is A Digital Asset ...

3451 x 2588

Complete Guide ÔÇô How to buy Bitcoin (or crypto) in ...

1714 x 909

Complete Guide ÔÇô How to buy Bitcoin (or crypto) in ...

1536 x 815

4656 x 3492

Poloniex Vs Bitfinex Price Forecast Ethereum ÔÇô PT Bali ...

1600 x 797

Where Can I Find Daily Updates Of Cryptocurrency Rates ...

1280 x 853

Gifts, Collabs, Conests, Art Trades, etc. by Jay-Pines on ...

1600 x 1899

Mulheres - Meninas - Mo├žas - Garotas - Ninfetas: Fevereiro ...

1280 x 960

Modelo: Dados de Identifica├ž├úo "Perfil Publico". - Ag├ncia ...

1199 x 1566

What is margin and leverage trading in crypto? The easiest way to explain margin trading in crypto is that you are borrowing money from your exchange to be able to trade bigger positions. For example, if your account size is $1000 and you trade with a x10 margin, your biggest position size would now be $1000 x 10 = $10,000. The Gemini mobile app does not support the Active Trader platform. However, it is still possible for you to use the Active Trader platform via your web browser. If you wish to trade on the go, you can login to Gemini on your mobile web browser. You are able to use the trading platform from there! How does Leverage work in Crypto Trading? - Delta ExchangeGemini Exchange Review 2022 Crypto Trading BrokersGemini ActiveTrader ┬« The high-performance crypto trading platform that delivers professional-level experience. Available to more active users, ActiveTrader features advanced charting, multiple order types, auctions, and block trading. Try ActiveTrader High speed. High stability ActiveTrader can execute trades in microseconds. Gemini, You really do have a great product, but offering a mobile version of Active Trader would greatly enhance the Gemini user experience and value. I find myself having to trade on other exchange platforms more often than IÔÇÖd like because there is no ability to control Gemini limit orders on the fly. How do I enable Gemini ActiveTraderÔäó? ÔÇô GeminiCrypto Trading Platform - Gemini ActiveTrader┬« GeminiThe Gemini exchange and Active Trader are both optimised for mobile, making them fantastic for on-the-go trading. The app is available on both Android and Apple and can be downloaded from the relevant app store. User reviews of the mobile application are excellent. Mobile trading. Crypto Margin & Leverage Trading in the USA Guide - Trading .Leverage+trading+crypto+exchanges NewsThe Ultimate Guide To Gemini Active Trader (2022 .The last 12 months the cryptocurrency market has seen a surge in demand for cryptocurrency . Gemini also offers a separate Active Trader platform for more advanced cryptocurrency traders. . while Gemini's web and mobile transaction fees range from $0.99 to $2.99 (and larger transactions . Can you use active trader on Gemini App? For Android users: Open Gemini ActiveTrader in your mobile browser. Select ÔÇťAdd to Home Screen,ÔÇŁ Add Title, and then tap ÔÇťAddÔÇŁ (Chrome Browser) or Select ÔÇťPageÔÇŁ > ÔÇťAdd Page ShortcutÔÇŁ (Firefox Browser) The link will then appear as an App on your home screen. Which is better Gemini or Coinbase? September 26, 2020. In the context of trading, youÔÇÖll often see the terms ÔÇśleverageÔÇÖ and ÔÇś margin trade ÔÇÖ being used interchangeably. Very often, they are used in conjunction with cryptocurrency derivatives. Therefore, to understanding leverage in crypto trading, we must understand crypto derivatives. Check out this post for an in-depth explanation. Beginner Sep 28, 2021 ┬Ě 6 min read. Key Takeaways: ÔÇö In leverage trading, you are basically borrowing money from the exchange and making a bigger wager than what you traditionally could with your own money ÔÇô i.e. you can make a $1000 wager with just $100. ÔÇö Although having high upside potential, leveraged trading is one of the riskiest forms of trading crypto because it requires a lot of education before safely navigating it . 2021ÔÇÖs Best C rypto Leverage Trading Platforms. 1. Bybit. Bybit is one of the most user-friendly crypto exchanges that is leverage on crypto futures markets, including some prominent crypto tokens. 2. PrimeXBT. 3. FTX. 4. Binance. 5. BitMEX. Can I Drawing Tools Gemini Active Trader - SeniorCare2ShareLeverage trading: What, Why, How? LedgerGemini ActiveTraderÔäó is a trading interface that offers advanced charting, additional trading pairs, order types, and deeper order book visibility. Once logged in, this will take you to your Profile Settings page where you can enable the ActiveTrader UI. You will also be able to switch between Gemini User Interfaces. Our ActiveTraderÔäó fee schedule can be found here. How do I use ActiveTraderÔäó on my mobile device? ÔÇô GeminiWhat Is Leverage In Crypto Trading BITLEVEXGemini mobile app and active trader : GeminiActiveTrader Fee Schedule GeminiOrders placed via our ActiveTrader interface (each, an ÔÇťOrderÔÇŁ) are subject to the rates on this schedule. Gemini utilizes a maker-taker fee model for determining trading fees for all Orders. Liquidity-making Orders are charged different fees than liquidity-taking Orders. If you place an Order that is filled immediately, this Order takes liquidity from the marketplace and, therefore, you are considered a taker and will be charged a taker fee. Open Gemini ActiveTrader in your mobile browser Select the share button for the browser window (Bottom middle for iPhone Safari) Select "Add to Home Screen," Add Title, and then tap "Add" The link will then appear as an App on your home screen For Android users: Open Gemini ActiveTrader in your mobile browser Leverage in crypto trading ÔÇô Winning trade example LetÔÇÖs say you have $100 dollars deposited on a crypto exchange: You choose to use X5 leverage to buy Bitcoin at $36.000. Leverage gives you the power to buy $500 worth of BTC at that price. The market moves in your favor and BitcoinÔÇÖs price rises 15%. Gemini review: Crypto trading with . - Business Insider11 Best Crypto Margin Trading Exchanges with Leverage 20229 Best Crypto Platforms For Leverage Trading (2022 .