coinbase tax forms forex brokers 2021

Iran to allow crypto payments for international trade ...

6 days ago

Crypto Tax Calculator Coinbase / Bitcoin Taxes Crypto ...

1280 x 1068

How To Buy Safemoon Via Kucoin - doramezo

1372 x 791

Do I Have To Report Coinbase On Taxes - Tax Walls

1157 x 1500

Interactive Brokers Margin Short Put For Day Trading – Dr ...

1672 x 897

Cryptocurrency Taxes: A Step-by-Step Guide & 10 Easy Tips

1080 x 1080

Cryptocurrency Taxes: The Ultimate Guide For Crypto Tax ...

1600 x 900

Free Crypto Tax Calculator Canada Reddit / Fastest Way To ...

1900 x 1268

Unmarshal Forms Strategic Partnership with Ethernity Chain ...

1920 x 1080

General Overview of the FBS Forex Broker - Trade in Forex

2048 x 1363

Forex Trading Software – News Anyway

1296 x 810

Daily Crypto Review, Jan 14 – Bitcoin Records Double-Digit ...

1200 x 800

La primera cripto ciudad de Estados Unidos podría ser ...

1440 x 900

KuCoin Review 2021: What is the KuCoin exchange? | Coin ...

1920 x 1080

Foro Económico Mundial retrasa la reunión anual de 2021 ...

2000 x 1267

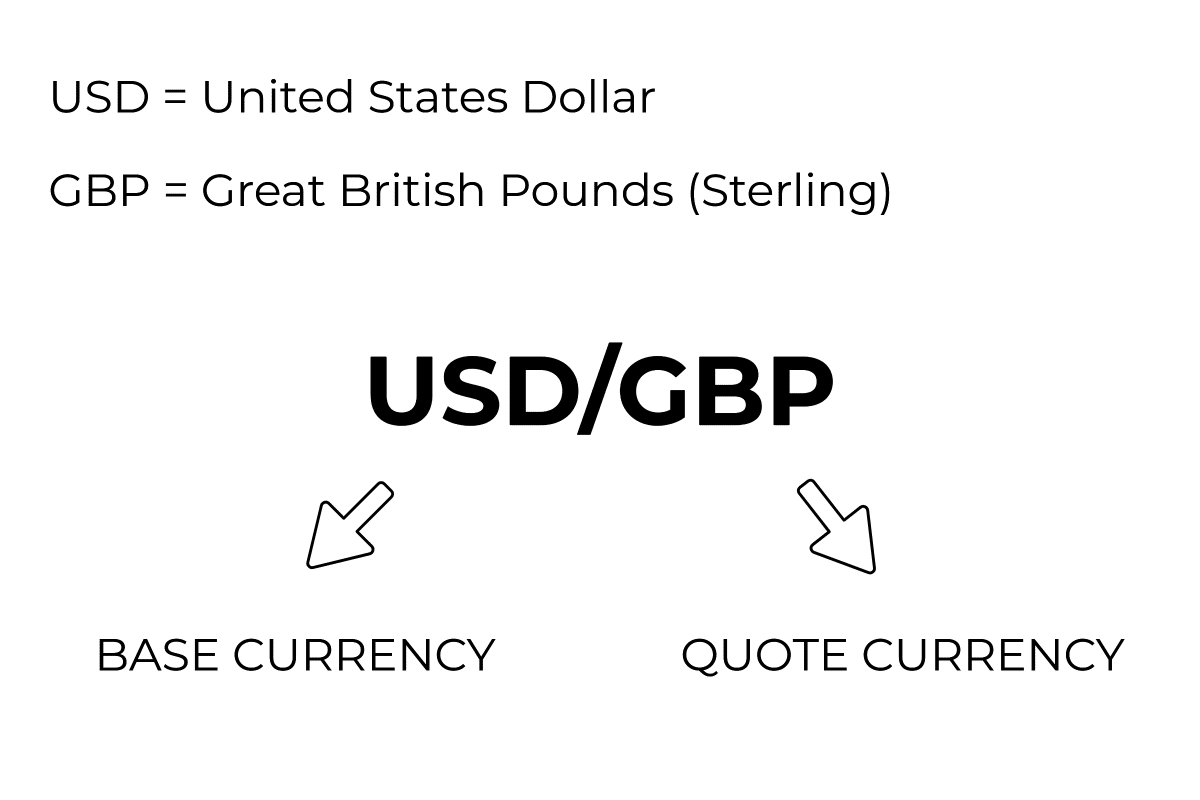

quotecurrency - Forex Trading Bonus

1200 x 800

(OBLN) - Obalon Surges 470% On ReShape Lifesciences Merger ...

1024 x 768

Powerball and Powerball plus results, Friday 30 July 2021

1200 x 850

¹Crypto rewards is an optional Coinbase offer. ²Limited while supplies last and amounts offered for each quiz may vary. Must verify ID to be eligible and complete quiz to earn. Users may only earn once per quiz. Coinbase reserves the right to cancel the Earn offer at any time. Guide to Crypto Taxes in Japan TokenTax(Ad) The foreign exchange, also known as forex, is a global marketplace for buying and selling currency pairs. The forex market is one of the largest and most liquid financial markets in the world . 8 Best Forex Brokers and FX Trading Platforms (2021 Reviews)Coinbase issues the IRS Form 1099-MISC for rewards and/ or fees through Coinbase.com, Coinbase Pro, and Coinbase Prime. It must be noted that the form is available only to American citizens and non-US customers will not receive any forms from Coinbase. Trusted Forex Brokers List - Forex Broker Comparison 2021Broker Min Deposit Regulated TopEdgeFX Signals and mentoring program N/A N/A TransparentFXTrading.com N/A N/A FXchoice $100 Yes Exness $1 Yes OctaFX $20 Yes Websites that Sell Professional Trading Software Product/service Type of Product/service Cost TopedgeFX Signals and Mentoring Forex Signals and Training $97 monthly TransparentFXtrading.com Trading mentorship and account funding Varies . Best Forex Broker 2019 - For US Based TradersUnderstanding Coinbase taxes Coinbase HelpCoinbasePro Tax forms? Is coinbase going to send me any tax forms in the mail? I tried to download an account statement for year 2021, and it is 121 pages long and does not tell me what my overall gain or loss is for the year. What can I do to make my taxes go as easy as possible? Overall I know I have a net loss of about $5000 based on how . Coinbase Tax Resource Center For the 2021 US tax season, Coinbase will issue the IRS Form 1099-MISC for rewards and/or fees through Coinbase.com, Coinbase Pro, and Coinbase Prime. Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. If you are subject to US taxes and have earned more than $600 on your Coinbase account during the last tax year, Coinbase will send you the IRS Form 1099-MISC. What a 1099 from Coinbase looks like. If you are a non-US Coinbase customer you will not be sent any tax forms by Coinbase, but you can still generate reports on the platform and then use these for your crypto tax software or to help your financial advisor. Coinbase - Buy and Sell Bitcoin, Ethereum, and more with trustOctaFX is a Forex and CFD trading platform with a focus on low, competitively priced spreads. It supports MT4, MT5, and cTrader trading platforms. cTrader offers the lowest costs, but does require . Forex Broker Reviews 2021: 550+ Trading Platform Review5 best Forex Brokers of 2021: Our guideEven if you earned staking or rewards income below the $600 threshold, you’ll still have to report the amount on your tax return. At this time, Coinbase only reports Form 1099-MISC to the IRS, but since crypto tax rules are still kind of messy, you may find other IRS forms on other crypto exchanges. Learn how the IRS taxes crypto Coinbase reports FXTM or short for Forex Time company has been named one of the fastest-growing forex brokers, and therefore, one of the best forex trading platforms of all time. Started in 2011 with a business . 9 Best Forex Brokers for 2022 - ForexBrokers.comWrapping up 2021 With a Look Back and Forward December 27, 2021 Looking Back at 2021 As the sun rose in 2021, the world was still reeling from the effects of COVID-19. Markets were affected, peop. Tax forms, explained: A guide to U.S. tax forms and crypto .IC Markets is the largest forex broker by trading volume, with over $774 billion in forex trading volume in the third quarter of 2021 alone, according to data compiled by Finance Magnates. Note: The largest broker may vary depending on the time period used to measure size. Connect CryptoTrader.Tax to your Coinbase account with the read-only API. Let CryptoTrader.Tax import your data and automatically generate your gains, losses, and income tax reports. File these crypto tax forms yourself, send them to your tax professional, or import them into your preferred tax filing software like TurboTax or TaxAct. Coinbase Tax Resource Center Coinbase Pro HelpTop 10 Best Forex Brokers 2022 - Trading Platform Reviews .Exness Company - Top Number 1 Broker in World - one.exness.linkCoinbasePro Tax forms? : CoinBaseVideos for Coinbase+tax+formsCoinbase Tax Documents to File Your Coinbase Taxes ZenLedgerBest Forex Brokers in 2021 - Topedgefx.comBest Forex Brokers Japan 2021 - Top Japanese Forex BrokersFBSから無料の140ドルを獲得 - 入金無しで取引する - レベルアップボーナスOther countries have been requesting client crypto transaction data from exchanges as well, including the United States where, as an example, Coinbase has sent user data to the IRS. Spain, Australia, and Denmark are a few more examples of countries where tax authorities have requested data from cryptocurrency exchanges. Coinbase Tax Resource Center For the 2020 US tax season, Coinbase will issue the IRS Form 1099-MISC for rewards and/or fees through Coinbase.com, Coinbase Pro, and Coinbase Prime. Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. How to do your Coinbase Taxes CryptoTrader.Tax3 Steps to Calculate Coinbase Taxes (2022 Updated)