what does coinbase report to irs best canadian trading platform

Coinbase Is a Popular Investment Platform, but Is It Safe?

2160 x 1131

Price Action Breakdown Pdf Download Define Binary Trading ...

1527 x 1122

Credit Card Rewards: Avoiding Eye Contact with the IRS ...

1378 x 1378

List of Canadian Stock Brokers And Large Investment Firms 2021

2560 x 1388

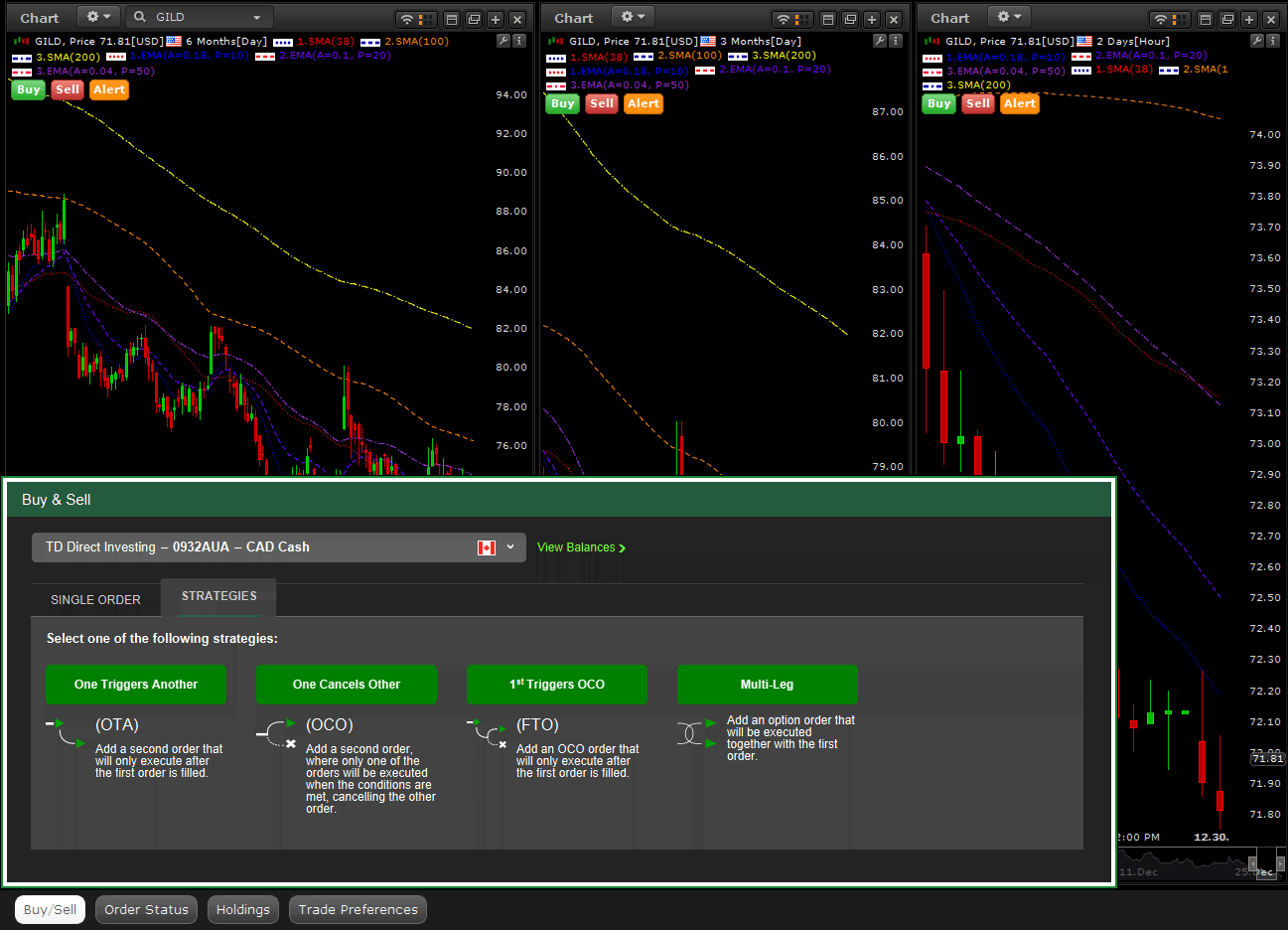

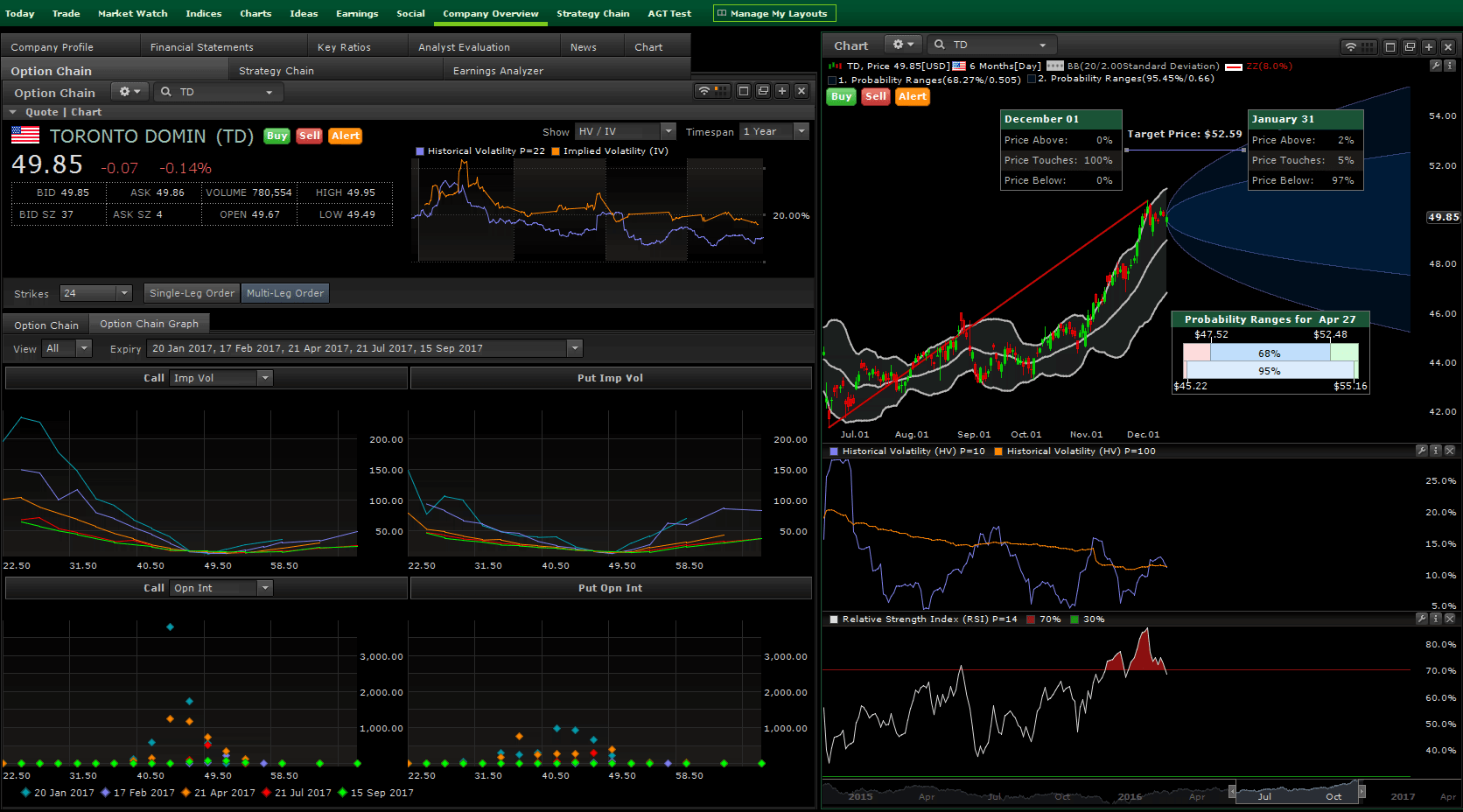

Advanced Dashboard | TD Direct Investing

1297 x 936

Best Platform To Buy Crypto In Canada - ProperSix is more ...

1024 x 799

Questrade Review | StockBrokers.com

1565 x 1037

Crypto Trading Platform Canada - 9 Best Crypto Bitcoin ...

3203 x 1940

Lowest Fee Crypto Exchange Canada - The Best ...

1464 x 1163

Foreign Forex Brokers Us Clients - Best Forex Ea In The World

1058 x 1497

Major Canadian Exchange Announces Support of EOS Token ...

2500 x 2083

Advanced Dashboard | TD Direct Investing

1672 x 928

Does Coinbase Report to the IRS? TokenTaxBest Canadian Brokers for Stock Trading. 1. Questrade. Overall. For residents of Canada, Questrade is the best online broker for trading, not only on the Canadian stock market, but also the . 2. Qtrade Investor. 3. Interactive Brokers. 4. TD Direct Investing. 5. CIBC Investor’s Edge. Trade with Interactive Brokers - Rated #1 Broker by Barron's7 Best Online Trading Platforms In Canada – Investing BasicsYes, you'll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not, Coinbase does report your crypto activity to the IRS if you meet certain criteria (you should be a Coinbase customer; a US person for tax purposes; should have earned $600 or more in rewards or fees from Coinbase Earn, USDC Rewards, and/or Staking). Does Coinbase Report to the IRS? ZenLedgerBest Canadian Forex Trading Platforms [January 2022]Best Stock Trading Platforms for Canadians 2021 - ????????Does Coinbase Report to the IRS? CryptoTrader.Tax8 Best Trading Platforms in Canada for December 2021 Finder .How to open a trading account. 1. Gather your personal information. To open an online trading account, you’ll need a valid government ID, social insurance number (SIN), address, . 2. Choose your account. 3. Fund your account. 4. Educate yourself. There are many things to consider when selecting the best stock trading platform. We compared fees, features and technology at some of the most popular online trading platforms in Canada. The 8 best stock trading platforms in Canada In Conclusion. Yes, Coinbase does report your crypto activity to the IRS if you meet certain criteria. It’s very important to note that even if you do not receive a 1099, you are still required to report all of your cryptocurrency income on your taxes. Not doing so would be considered tax fraud in the eyes of the IRS. Top Forex Trading Platforms In Canada The December 2021 best Canadian forex broker list is. IIROC Regulated Brokers Avatrade - Best Broker Overall FXCM - Has Great Trading Platform Features Oanda - Top Broker With MetaTrader 4 Forex.com - Good Broker For Low Spreads Forex.com - Good Broker For Low Spreads Simpler Trading - Small Account Secrets - Sign Up NowCoinbase Tax Documents to File Your Coinbase Taxes ZenLedgerWhat exactly does CoinBase report to the IRS? - QuoraNow in the coming year (2021), Coinbase will not issue Form 1099-K. They will only be reporting 1099-MISC for those who received $600 or more in cryptocurrency from Coinbase Earn, USDC Rewards, and/or Staking in 2020. You can learn more about how Coinbase reports to the IRS here. Best Trading Platforms in Canada - 2022 Guide [Updated .Videos for Best+canadian+trading+platformDoes Coinbase report to the IRS? Yes. Currently, Coinbase sends Forms 1099-MISC to users who: Are U.S. traders. Made more than $600 from crypto rewards or staking in the last tax year. The exchange sends two copies of the form: One to the taxpayer and one to the IRS. About online trading platforms in Canada. Here is a little primer on the seven trading . It’s incredibly important to track and report all cryptocurrency transactions to avoid a crackdown from cryptocurrency platforms and the IRS. The Big Question: Does Coinbase Report to the IRS? The answer? Yes. Coinbase, the top cryptocurrency exchange in the United States, began submitting 1099 forms to the IRS and individual users in 2017. Though the company stands out as one of the safest and most secure platforms for cryptocurrency selling and trading, it has butted heads with the IRS . Does Coinbase Report the IRS KoinlyUnusual Options Activity - As Seen on CNBCAlthough Interactive Brokers (IB) isn’t a Canada based-company, its US based-trading suite comes with features that Canadians love. It offers full access to major markets around the world, and has been rated as a Top Online Broker for nine consecutive years by Barron’s. Let's go over some of the basics here. First, you need to know about the form 1099-K. This is an IRS form that Coinbases uses to report financial transactions - like a W-2 from an employer, or a 1099-INT for bank interest. The only difference? It states that you received money (not necessarily income). It's to alert the IRS to look a Does Coinbase report to the IRS? Yes. Coinbase reports your cryptocurrency transactions to the IRS before the start of tax filing season. As a Coinbase.com customer, you'll receive a 1099 form if you pay US taxes and earn crypto gains over $600. Yes. Crypto exchange Coinbase began submitting 1099 forms to the IRS and to individuals users in 2017. Coinbase On Reporting To The IRS As with any other cryptocurrency present in the market space, Coinbase reports to the IRS via sending out the 1099-MISC form. The form here is sent out in two copies, one that goes to the eligible user who has more than $600 obtained from the crypto stalking or rewards, while the other is sent to the IRS directly. Trade Nearly 24hrs a Day - SPX Index Options - cboe.comCoinbase to Stop Reporting Form 1099-K to IRS and Customers .Quotex - Trading Platform - Official SiteWhat To Do With Your Coinbase Tax Documents? Let’s Find Out!5 Best Online Brokers Canada for 2022 StockBrokers.com