leverage on binance web trader

How To Trade Binance Coin With Leverage on Binance Futures ...

1580 x 888

How To Trade Dogecoin With Leverage on Binance Futures ...

1580 x 888

Crypto Spot vs. Crypto Futures Trading - What’s the ...

1600 x 900

Binance Futures, yeni kullanıcılar için kaldıraç limitini ...

1434 x 955

Bitcoin traders nervous after $19.5K rejection — Here are ...

2476 x 1122

Futures trading Binance - Finandy Docs

1728 x 1098

Zilliqa (ZIL) Staking to be Available on Binance Soon ...

1536 x 768

Binance.com Review 2021 – Scam or Not?

1915 x 961

Cardano, Ontology, Crypto.com Coin Price Analysis: 19 ...

1937 x 1073

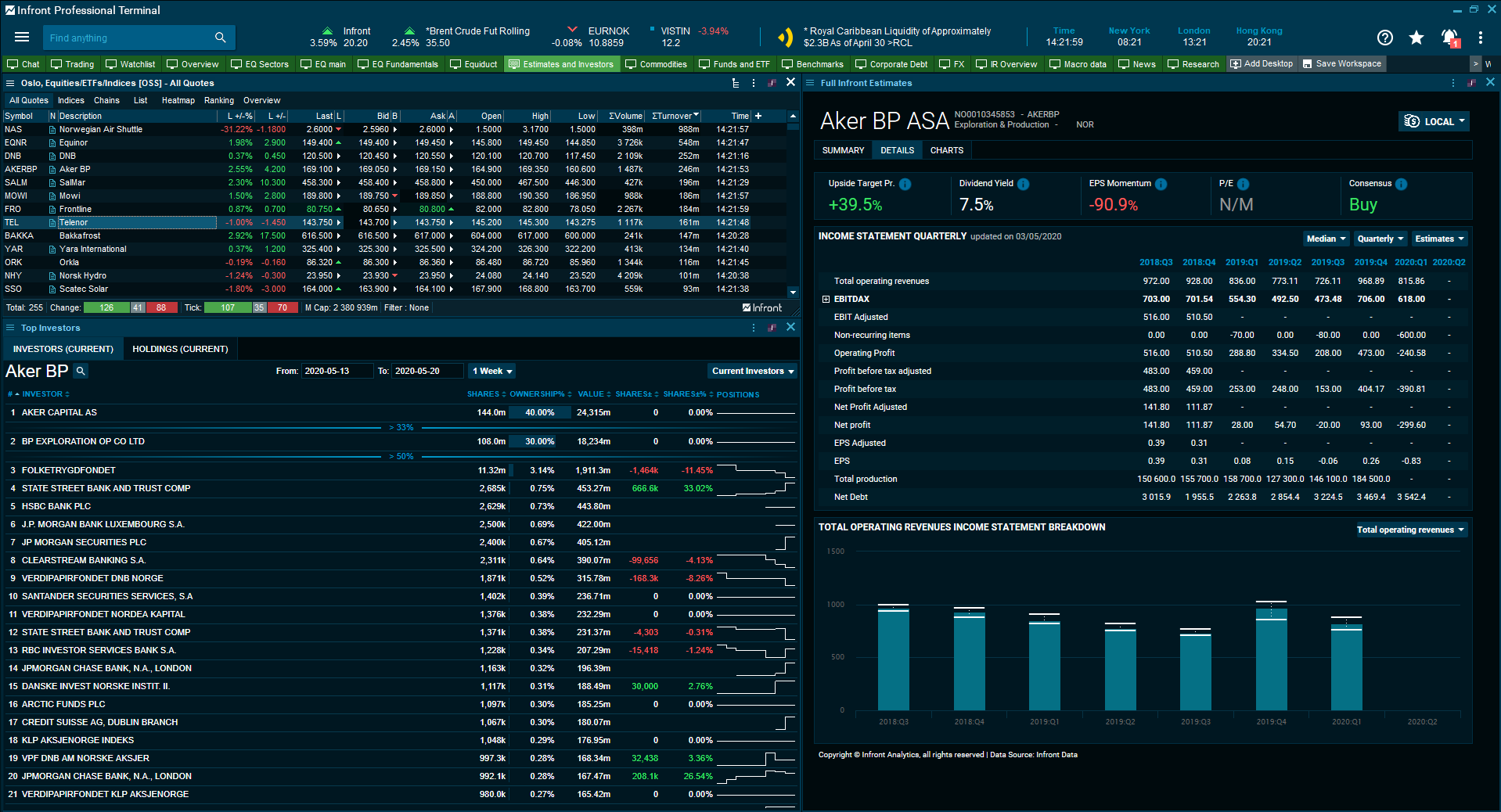

Norwegian Shares - Infront Top 50 Investors

1918 x 1038

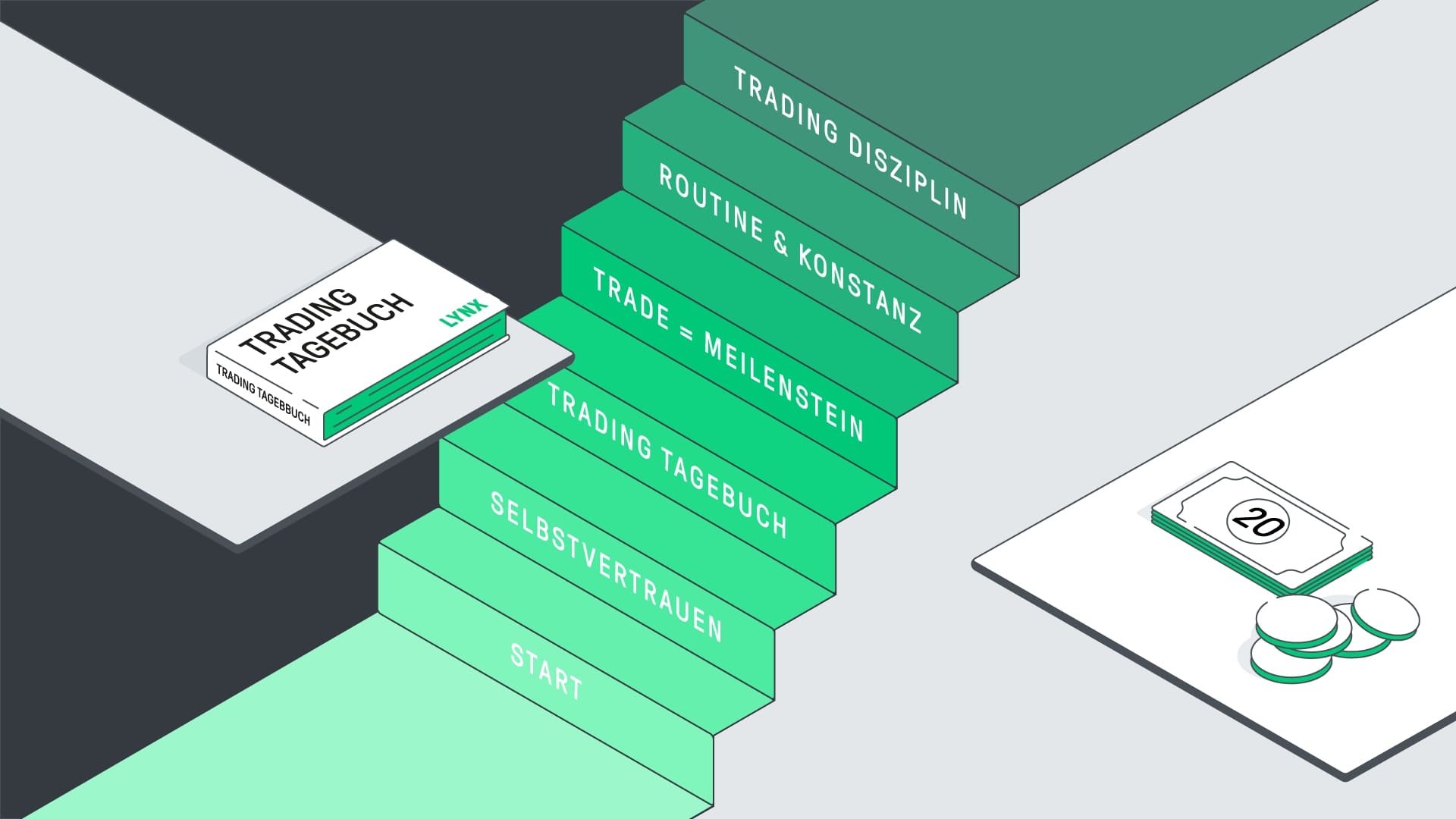

Wie Sie schrittweise Trading-Disziplin aufbauen | Traden ...

1920 x 1080

What Are The Best Free Forex Trading Systems? - Admirals

1440 x 810

Wie finde ich den besten DAX ETF für meine ...

1400 x 810

What Is the Effect of GDP on Financial Markets? | Admiral ...

1440 x 810

5 Best Forex Trading Platforms you don't know - Find the ...

1200 x 800

Difference Between Fiscal and Monetary Policy

1500 x 1001

SimpleFX Review 2021: Pros, Cons & Ratings ...

1504 x 928

Trade name and commercial license | CAPEX.com

1200 x 1697

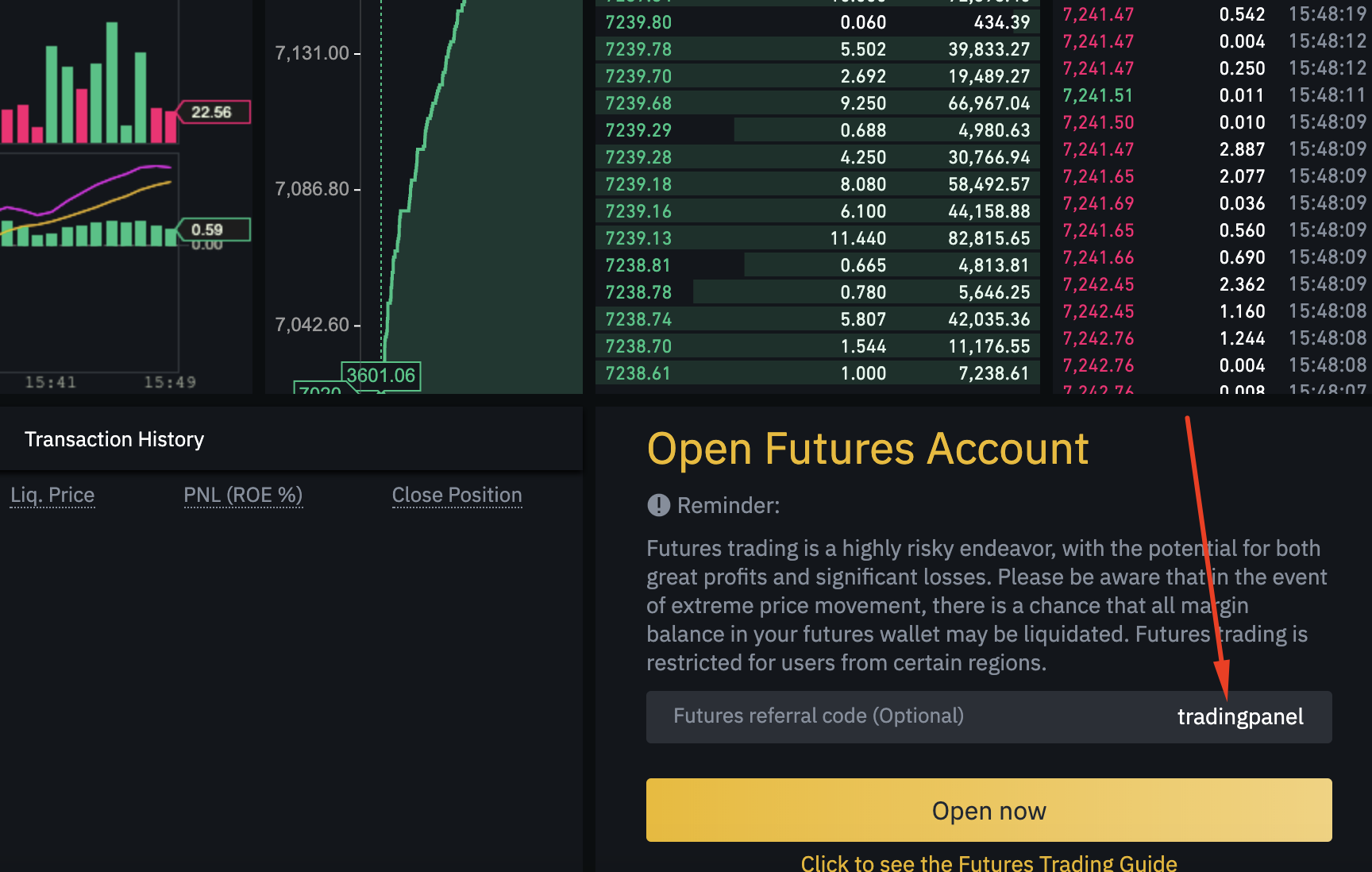

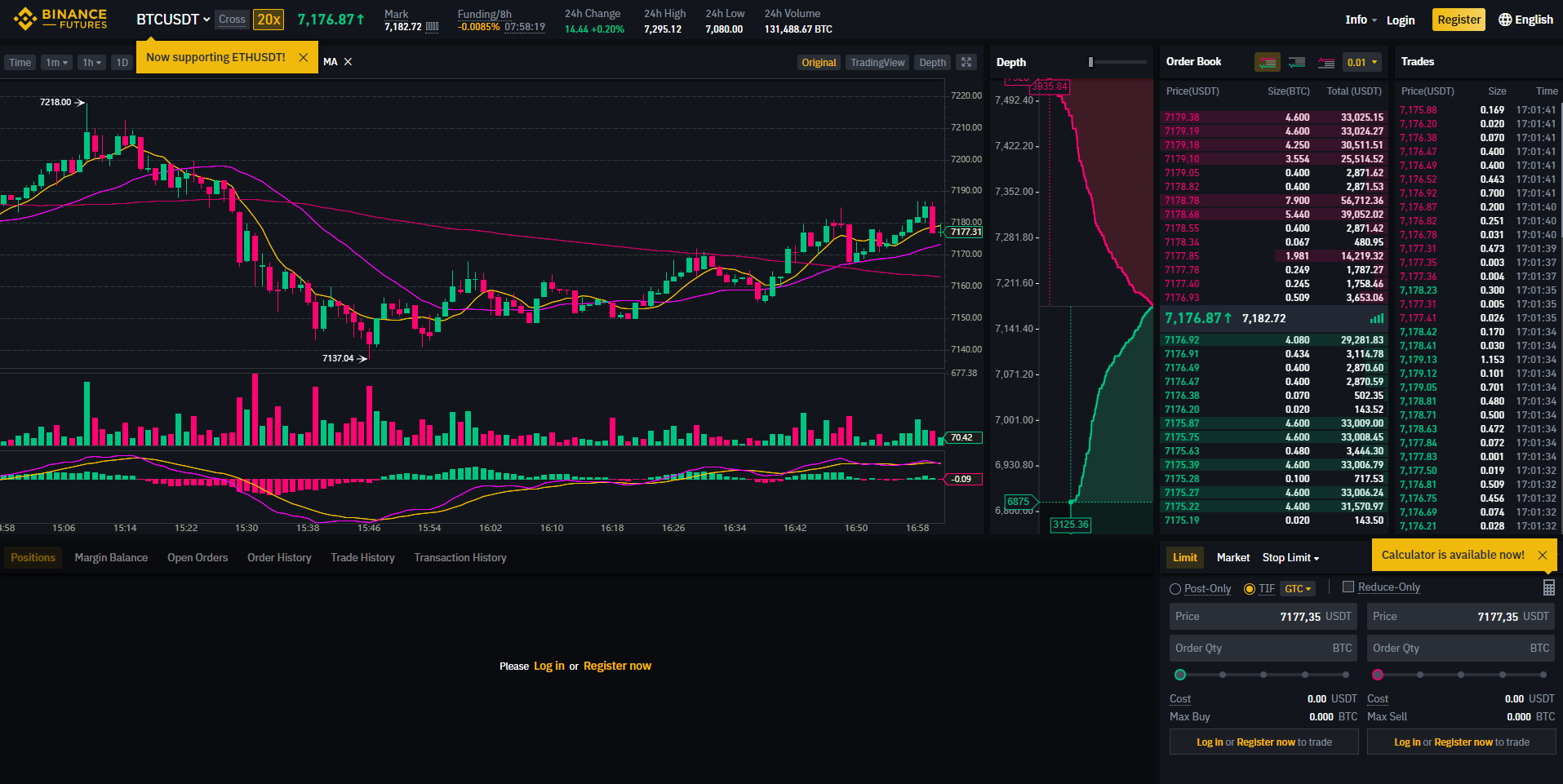

Your Essential Guide To Binance Leveraged TokensWhat Are Binance Leveraged Tokens BinanceWebTrader PROUnlike conventional leveraged tokens (not managed by Binance), Binance Leveraged Tokens do not maintain constant leverage. Instead, Binance Leveraged Tokens attempt to maintain a variable target leverage range between 1.25x and 4x. This would maximize profitability on upswings and minimize losses to avoid liquidation. 2019-10-18 02:40. Binance supports high leveraged transactions through the use of complex risk control engines and settlement models. By default, leverage is set to 20x. You may adjust the leverage to your preference. The higher the leverage, the lower value of the trader's position. Refer to the load test web site for information about load test submissions. 6. Read the User Guide and tutorials on the FDA ESG web site. Review WebTrader System Requirements. WebTraderBinance Leveraged Tokens (BLVT) are tradable assets in the spot market that allows you to gain leveraged exposure to a cryptocurrency without the risk of liquidation. Binance leveraged tokens eliminate the intricacies of managing a conventional leveraged position as users are not required to pledge collateral or maintain margin. Videos for Web+traderThe WebTrader is an innovative online trading platform designed especially for traders looking for a simple and uncluttered interface. With its easy to use dashboard and modern design, online trading has never been so simple. Options Trading Made Easy - Beginner's Guide To TradingUnlike conventional LTs, BLVTs do not maintain ‘constant’ leverage. Instead, BLVTs maintain a variable target leverage range between 1.5x and 3x. It is tradable in the Binance Spot Advanced trading interface and tracks the BTC perpetual contracts on Binance Futures. Currently, BLVTs are offered in two types: BTCUP and BTCDOWN. On July 19th, 2021, Binance Futures started limiting leverage levels up to a maximum of 20x for accounts opened within 30 days. This new rule was further enhanced on July 27th, where we decided to further extend the leverage limits for new accounts from 30 days to 60 days. CMTrading Webtrader is a quality, reliable trading platform. From accurate currency conversions to an elevated level of security, our Webtrader has it all. Therefore, the platform has become the most desired choice among traders worldwide. How to Adjust Contract Leverage BinanceGutscheine Review 2021 - Get a 20% Fee DiscountDoes Lower Leverage Make Better Sense for Your Trading .Web Trading Platform - Trade from your Browser AvaTradeIBKR WebTrader Interactive Brokers LLCPrimeXBT™ Official Site - PrimeXBT — #1 Trading PlatformEffective July 27th, 2021, Binance Futures set leverage limits for users who registered their futures accounts in less than 60 days. The following leverage limits will apply: From the effective date, new users with registered futures accounts of less than 60 days will not be allowed to open positions with leverage exceeding 20x. IBKR WebTrader, Interactive Brokers’ HTML-based trading platform, offers an uncluttered, easy-to-learn trading interface with advanced trading features and tools. CMTrading Webtrader - Online TradingUnusual Options Activity - Start Trading Unusual ActivityLeverage & Margin of Futures Contracts Binance FuturesSetting up a WebTrader Account Checklist FDABinance Leveraged Tokens BLVTs Binance FuturesBinance Says It's Cutting Leverage Limit to 20x, a Day After .WebTrader PRO. Show Password. Forgot password? We take protection of your data seriously. Leverage and Margin of USDⓈ-M Futures BinanceLeverage levels and margin ratios of futures contracts on Binance: position sizes allowed at different leverage levels, initial margin and maintenance margin ratios. I agree to the terms set forth in the Rules of Behavior. View Rules of Behavior The new limit is 20 times leverage, the exchange's founder and CEO Changpeng Zhao said in a tweet Monday, down from 100 times. Binance imposed the limit on new users on July 19, and will gradually. Ready To Trade Options? - 5 Winning Options Strategies