contract for difference best algorithm for stock trading

Pre

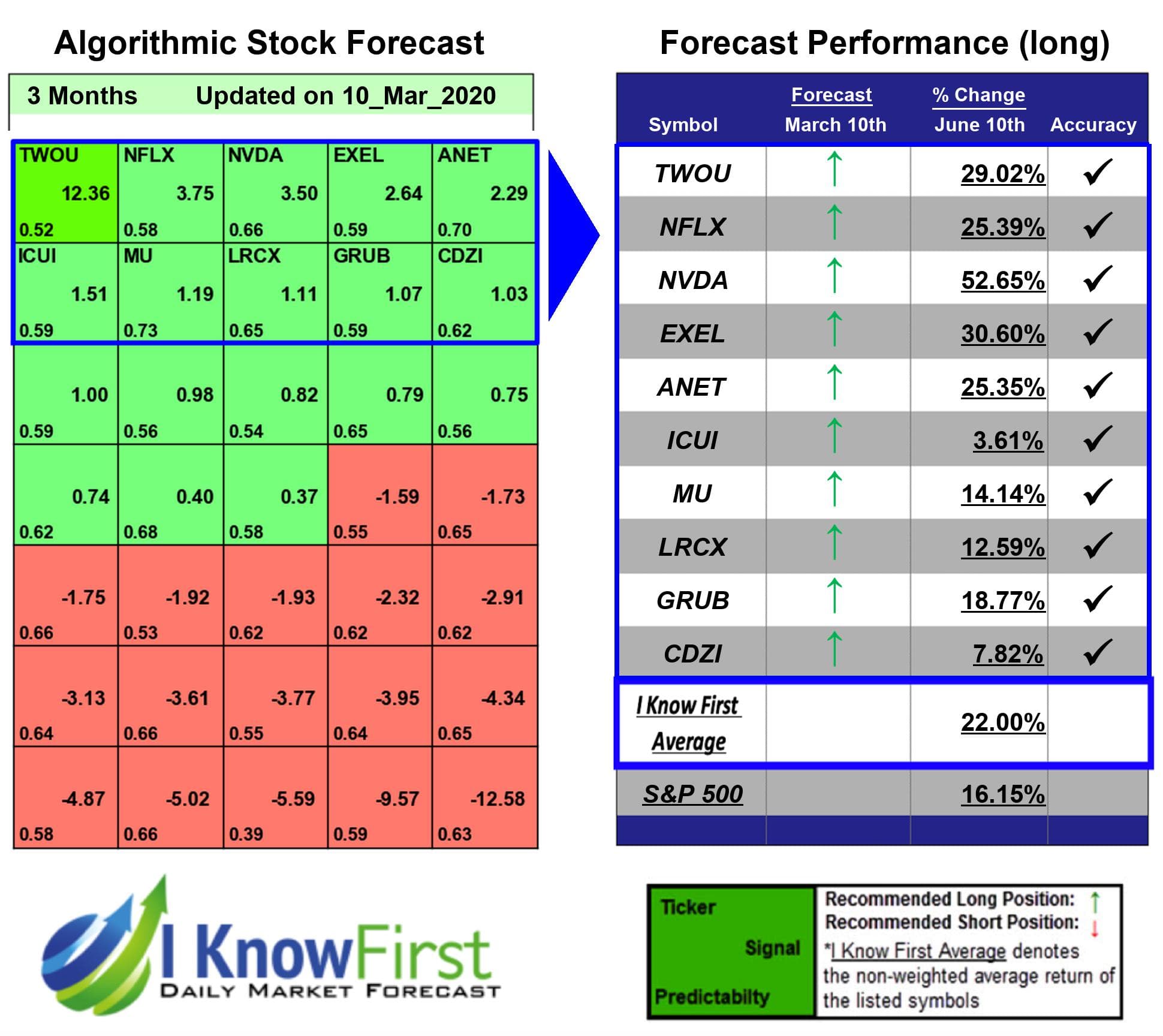

Stock Forecast Based On a Predictive Algorithm | I Know ... 1940 x 1728

Algorithmic trading (also called automated trading, black-box trading, or algo-trading) uses a computer program that follows a defined set of instructions (an algorithm) to place a trade. The .

In finance, contracts for differences (CFDs) – arrangements made in a futures contract whereby differences in settlement are made through cash payments, rather than by the delivery of physical goods or securities – are categorized as leveraged products.

In conventional financial market analysis, a contract for differences (CFD) is an agreement to exchange the opening and closing prices of some financial asset.

Basics of Algorithmic Trading: Concepts & Examples

Best books on algorithmic trading for 2022 Trality

7 Best Algorithmic Trading Courses Online • Benzinga

Algorithmic trading is the biggest technological revolution in the financial markets space that has gained enough traction from the last 1 decade. Most of the equity, commodity, and forex traders (including the retail participants) are rapidly adopting algorithmic trading to keep up the pace.

10.2.3 Contracts for Differences EBF 483: Introduction to .

A Beginners Guide To Options - Perfect For Rookie Investors

Contract for Difference - Understanding How a CFD Works, Examples

5 Excellent Algorithmic Trading Platforms - Includes Detailed .

A contract for differences (CFD) is a financial contract that pays the differences in the settlement price between the open and closing trades. CFDs essentially allow investors to trade the.

Algorithmic trading is one of the most popular ways to use computers in the financial markets. Major banks and Wall Street institutions use algorithms to trade anything from traditional assets such as stocks to newer markets like cryptocurrencies.

Best Algorithmic Trading Platforms 2022 Trade Options With Me

In finance, a contract for difference ( CFD) is a contract between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time (if the difference is negative, then the seller pays instead to the buyer).

Contract for difference - Wikipedia

Most algorithmic trading software offers standard built-in trade algorithms, such as those based on a crossover of the 50-day moving average (MA) with the 200-day MA. A trader may like to .

Beginner's Guide To Trading - Top Options Trading Strategies

Contract for Differences (CFD) Definition

Contracts for Difference: an EMR CfD Primer

Pick the Right Algorithmic Trading Software

Nationwide® For Professionals - Risk-Managed Income ETF

Contract for Differences (CFDs) Overview & Examples

Contract for difference – WinMarket

Cboe Index Data (CSMI) - Cboe Streaming Market Indices

The Best Algo Trading Platforms. Quantopian. Quantopian once was the biggest and most popular algorithmic trading platform. They offered a rich collection of free equities and futures . QuantConnect. Quantiacs. MetaTrader. Build Your Own.

A Contract for Difference (CFD) refers to a contract that enables two parties to enter into an agreement to trade on financial instruments. Marketable Securities Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company.

Contracts for Difference; Capacity Market Mechanism; Carbon Price Floor; and Emissions Performance Standard. The EMR reforms have three key aims: to bolster the security of electricity supplies, encourage the decarbonisation of the power sector and keep energy affordable. This briefing looks at the Contract for Difference (CfD).

A contract for difference (CFD) is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the current value of an asset and its value at.

Videos for Contract+for+difference

Algorithmic trading (black-box trading, algo trading, automated trading, or whatever you like to call it,) is an automated process that uses algorithms to seek and purchase or sell stocks based on .