amm liquidity pool trading platforms to trade crypto

Pre

First Automated Liquidity Pool SmartHoldem STH 4355 x 1861

My Top Platforms to Trade Crypto. 1. Coinbase. We may as well start with the top dog, Coinbase ( NASDAQ:COIN). With 7.4 million monthly transacting users and $255 billion in assets on . 2. Gemini. 3. Celsius Network.

As can be seen from the above table, even if Uniswap stops distributing tokens to the liquidity pool, the annualized income of LP is still at a high level, which confirms the high transaction volume of the top AMM trading platform.

10 Best Crypto Exchanges and Platforms of January 2022 .

Build a Crypto Portfolio - Most Secure, Trusted Platform

What Is an Automated Market Maker (AMM)? Gemini

Based on our reviews, these are the top platforms to trade Bitcoin, crypto, stablecoins and DeFi tokens: Binance (best for low fees) Coinbase Pro (best for beginners) FTX (best for leveraged tokens) ByBit (best for margin trading) Kraken (best for advanced trading) KuCoin (best for altcoins) eToro (best for copy-trading)

On AMM platforms, instead of trading between buyers and sellers, users trade against a pool of tokens — a liquidity pool. At its core, a liquidity pool is a shared pot of tokens. Users supply liquidity pools with tokens and the price of the tokens in the pool is determined by a mathematical formula.

AMM Liquidity Pools : AquariusAqua

The platform is ideal for crypto beginners giving them a familiar interface to trade other conventional financial instruments such as stocks, commodities, ETF (Exchange Traded Funds), and Options. The platform has over 13 million users already, which proves its popularity.

Liquidity Pools - Sushi

My Top Platforms to Trade Crypto The Motley Fool

Award Winning Trading Platform - Interactive Brokers®

This mechanism is also called an automated market maker (AMM) and liquidity pools across different protocols may use a slightly different algorithm. Basic liquidity pools such as those used by Uniswap use a constant product market maker algorithm that makes sure that the product of the quantities of the 2 supplied tokens always remains the same.

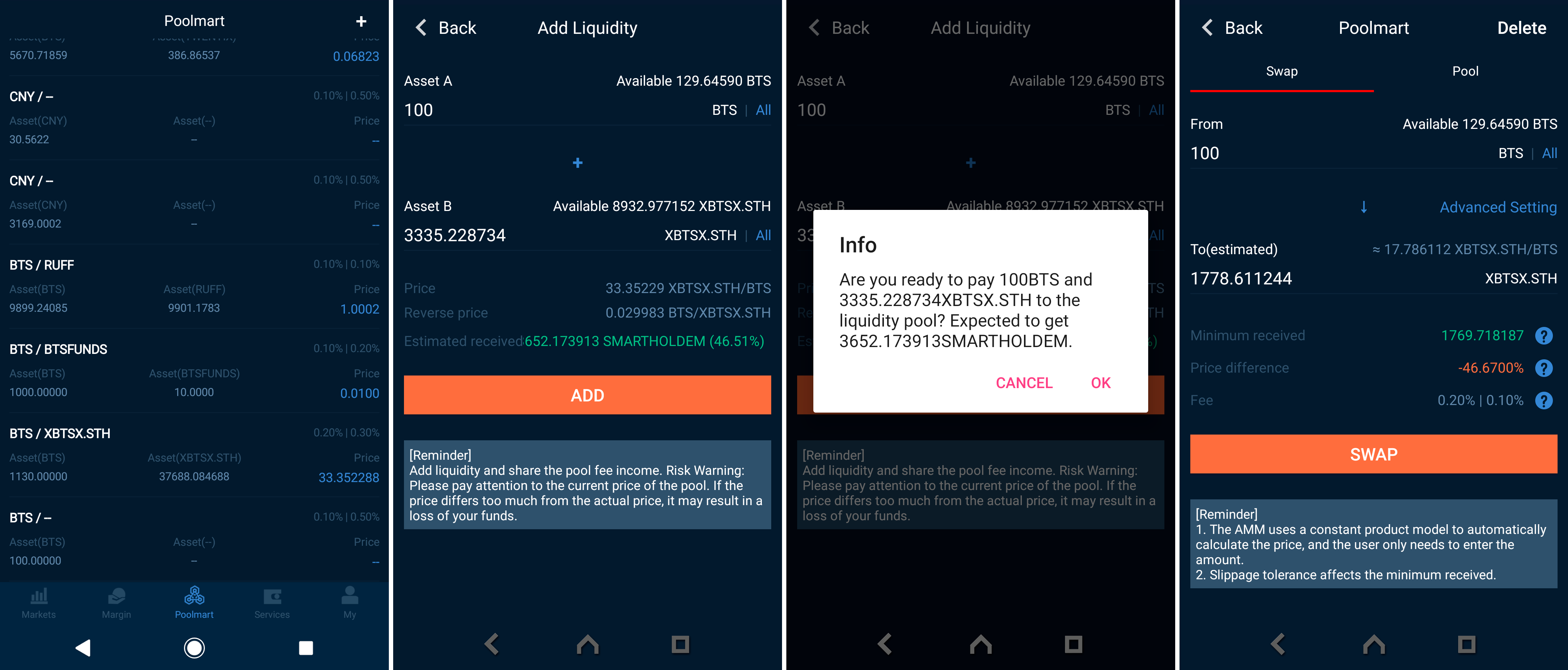

Once in, head over to the AMM section to access your AMM dashboard. To start providing liquidity, select Add Liquidity option. You can use the dropdown menus to select the two assets you would like.

In this article we will take a look at the 15 best cryptocurrency trading platforms in 2021. You can skip our detailed analysis of the crypto industry’s outlook for 2021 and go directly to 5 .

What is an Automated Market Maker (AMM)? - DeFi - Phemex Academy

Coinbase – Best Cryptocurrency Trading Platform for First-Time Buyers; Libertex – Best Cryptocurrency Trading Platform for Tight Spreads; Kraken – Best Cryptocurrency Trading Platform for Europeans; Gemini – Best Crypto Trading Exchange for Large Investments; Luno – Best Crypto Broker for Mobile Trading

Robinhood brings its no-fee ethos to cryptocurrency trading, but currently offers few cryptocurrencies and no way to transfer crypto assets off the platform.

Best Cryptocurrency Trading Platforms [2022] Beginner's Guide

15 Best Cryptocurrency Trading Platforms in 2021

AMMs on StellarX. What are AMMs and how to use them with .

Liquidity pools are place to pool tokens (which we sometimes call liquidity) so that users can use them to make trades in a decentralized way. These pools are created by users and decentralized apps (or Dapps, for short) who want to profit from their usage. To pool liquidity, the amounts a user supplies must be equally divided between two coins .

The formula used by Uniswap’s AMM, for example, is x*y=k — where the X and Y represent the amount of each token in the pool, and K is a predefined constant. Due to the way AMMs work, there will always be some slippage with every trade. As a general rule, however, the more liquidity there is in a pool, the less slippage large orders will incur.

This has caused more investors to get interested in liquidity pools, part of the AMM model of Uniswap. Many are drawn to providing liquidity with attractive farming rewards, but that is only one part of the equation. This article helps understand the various factors to consider when providing liquidity to Uniswap style AMM’s.

10 Best Crypto Trading Platforms To Buy Altcoins .

Best Crypto Trading Platforms 2022 - Trade Crypto Today

How Do Liquidity Pools Work? DeFi Explained – Finematics

Can AMM liquidity mining become a sustainable business model .

AMM Liquidity Pools : AquariusAqua Do the Stellar liquidity pools work like Osmosis where you put in your two coins to the pool and then each day you get Aqua sent to your wallet like … Press J to jump to the feed. Press question mark to learn the rest of the keyboard shortcuts Search within r/AquariusAqua r/AquariusAqua Log InSign Up

Trading+platforms+to+trade+crypto News

AMM pool working mechanism The AMM pool provides liquidity for token transactions, and the structure of the number of tokens in the pool will change after each transaction. Each transaction in the AMM pool is charged a transaction fee and distributed to fund participants. Different mechanisms are used between different AMM platforms.

Understand the DeFi liquidity pool: lending, AMM and option .

How to maximize profit and identify risk in AMM liquidity pools