nasdaq marketplace coinbase pro trading rules

Pre

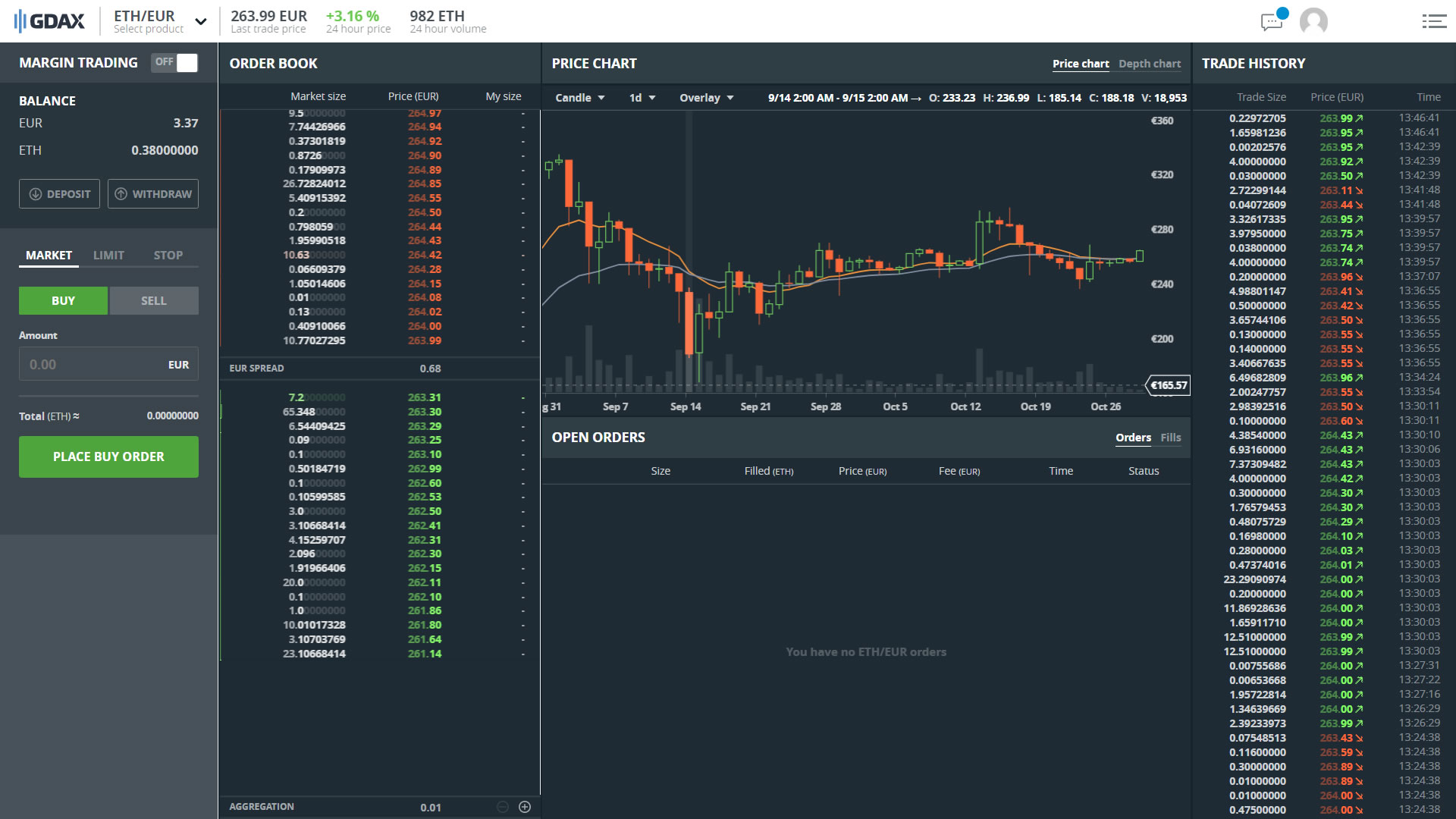

Setting up your Hopper with a Coinbase Pro account 1920 x 1080

What are the limits on Coinbase Pro? Coinbase Pro Help

With Nasdaq technology, marketplaces can draw value from years of global capital markets experience -- from the world’s largest pool of market infrastructure resources on the planet -- that.

Trading rules Coinbase Pro Help

Coinbase Markets Trading Rules 1. Trading on Coinbase Pro and Coinbase Exchange. Each Trader’s Account will list which Order Books are available to the. 2. Market Integrity. Due to a serious technical error, Orders or Fills do not occur as specified in these Rules - in. 3. Access to Information. .

Cboe Market Data Services - Premier Market Data Supplier

For the day, the Dow plummeted 313.26 points or 0.89 percent to finish at 34,715.39, while the NASDAQ plunged 186.23 points or 1.30 percent to close at 14,154.02 and the S&P 500 sank 50.03 points .

There are three phases to the auction before the order book returns to Full Trading or Limit Only: Collection, Match, and Completion. Collection This is the longest phase where the indicative price is established. Limit orders (without post-only) can be placed during this phase of the auction.

COINBASE USER MARGIN TRADING AGREEMENT. This is an agreement between you, Coinbase Credit, Inc. ( “Lender”) and Coinbase, Inc. ( “Agent”) for the provision of short-term loans from Lender to you ( “Agreement” ). Subject to the terms and conditions below, this Agreement permits you to borrow fiat money from Lender to purchase “Digital Assets” (known as trading on margin) through your account on Agent’s trading platform ( “Coinbase Pro Account”) found at coinbase.com, pro .

What are the fees on Coinbase Pro? Coinbase Pro Help

Coinbase User Margin Trading Agreement Coinbase Pro Help

Japan could open up to blank-cheque listings but with its own safeguards for investors, the head of the Tokyo bourse said, as the government scrambles to grow startup firms as a way to revitalise .

Read about our cover for your investing, how we hold your API Keys, how you can connect Coinrule to Coinbase Pro and what trading rules you need to take profit Bitcoin. Create Automatic Rules with Coinrule and let us know if you have any questions!

When you first create your Coinbase Pro account, the withdrawal limit is $50,000/day. See your Limits page for your current withdrawal limit and to request an increase to your limit. Trading and order size limits There is no limit to the amount of orders you can place across all markets, but there is a limit on the size or amount for each order.

InvestNext - Instantly Fund Commitments - investnext.com

Crypto trading bots can be functioned to your needs and will essentially find the best opportunities in the market for you to make money. And you can just sit back and watch the money come in. In this article we will be going over some of the best trading bots for Coinbase Pro.

Nasdaq Launches the Marketplace Services Platform Nasdaq

Top Ranked ETF - How This ETF Ranked First - forbes.com

Japanese Market Sharply Lower Nasdaq

Best Trading Bots For Coinbase Pro WealthyDR

What are the fees on Coinbase Pro? Trading Fees. Coinbase Pro uses a maker-taker fee model for determining its trading fees. Orders that provide liquidity (maker orders) are charged different fees than orders that take liquidity (taker orders). Fees are calculated based on the current pricing tier you are in when the order is placed, and not on the tier you would be in after a trade is completed. Your fee tier is recalculated hourly based on your total trading volume.

Trading Rules - Coinbase

Nasdaq Marketplace Services Platform Facilitates the frictionless exchange of assets, services & information across market ecosystems This Solution Helps Market Infrastructure Organizations New.

Nasdaq's market technology powers more than 250 of the world's market infrastructure organizations and market participants, including broker-dealers, exchanges, clearinghouses, central securities.

Nasdaq+marketplace News

Stock Market Data Feeds - Corp Press Release Data Feeds

Tokyo bourse chief says SPACs possible in Japan . - nasdaq.com

Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq.

Nasdaq - Daily Stock Market Overview, Data Updates, Reports .

Marketplace Trading Technology Nasdaq

Auto trading on Coinbase Pro with Bitcoin - Coinrule

Step A: Sign in to your Coinbase account (or create a Coinbase account if you do not have one) and then opt-in at https://www.coinbase.com/sweepstakes/q4_dec_21_trading. Step B: Make a trade (buy/sell) of $100.00 or more of any crypto (including stable coins etc.).

What is Auction Mode? Coinbase Pro Help

Videos for Nasdaq+marketplace

Small Account Secrets - Stock Trading For Dummies

Trading Marketplace Platform - Cloud Matching Engine Nasdaq

Buy/Sell cryptocurrency - Coinbase

Trading rules Coinbase Markets is Coinbase's set of limit order books that are accessed by clients through the Coinbase Pro trading platform. The Coinbase Markets Trading Rules governs orders placed via these trading platforms.