crypto price alerts i trust capital roth ira

Pre

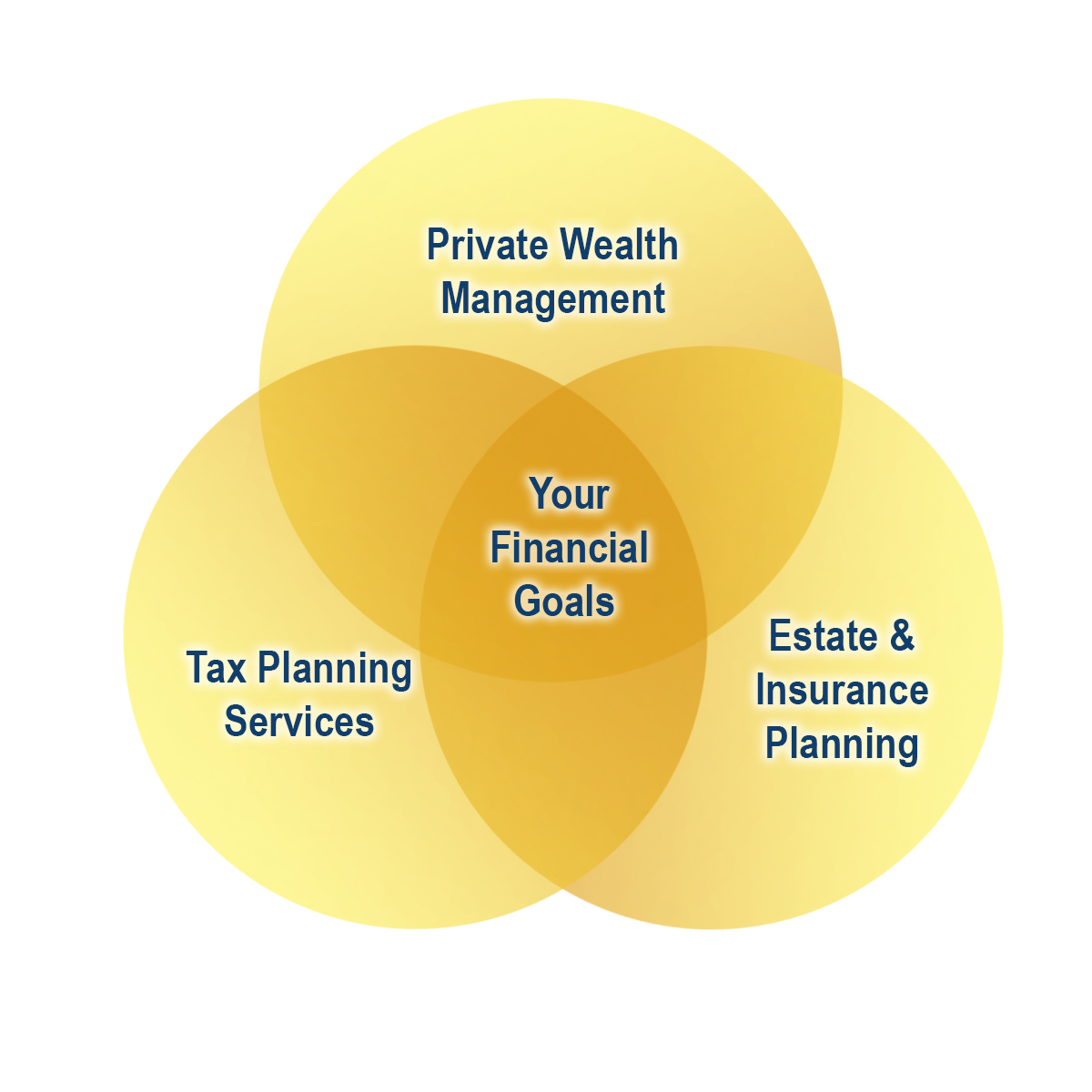

Our Services - Gulf Coast Wealth Advisors - Jeff LaBelle 1200 x 1200

IRA Trusts - Fully Customizable

Never pay 10-15% to put Bitcoin in your IRA. Other Bitcoin IRAs actually charge that much! Join the 1,000’s of iTrust account holders who say NO to high fees

Traditional vs. Roth: An IRA Comparison iTrust Capital

CryptoCurrency Price Alert - coinmarketalert

Crypto Price Alerts CoinCodex

Official Vanguard Site - Roth IRA Income Limits

Bitcoin + Crypto Price Alert - Cryptocurrency Alerting

iTrustCapital The #1 Crypto IRA Retirement Platform

The 3 Ways to Fund your iTrustCapital IRA There are 3 ways to fund an IRA. Depending on your situation, you can fund it with one or possibly multiple ways. 1) Transfer an Existing IRA IRA examples: Traditional, Roth, SEP, Simple, Inherited, Rollover Existing IRAs can be transferred to a new IRA without creating a taxable event or penalty.

Videos for I+trust+capital+roth+ira

Cryptocurrency Alerting on the App Store

I+trust+capital+roth+ira - Image Results

Roth IRA Contribution Guidelines for 2021 If you are single, you must have a modified adjusted gross income under $140,000 to contribute to a Roth IRA, but contributions are reduced starting at $125,000. If you are married filing jointly, your MAGI must be less than $208,000, with reductions beginning at $198,000.

Roth IRA Conversion iTrust Capital

iTrustCapital The #1 Crypto IRA Retirement Platform

Converting a Traditional IRA, 401k, 403b or other Pre-tax accounts into a Post-tax Roth IRA. If given a choice, most people want the tax-benefits of a Roth IRA over any other type of retirement account. However, converting a pre-tax IRA or employer plan may not always be the right move for everyone. Although the income limits were removed in .

General rules for new contributions to a Roth IRA. For 2021, the maximum contribution to a Traditional or Roth IRA is $6,000 per year if you are under 50 years old and $7,000 per year if you are over 50 years old. You can contribute to ANY IRA until April 15th of the following year. (i.e., 2020 contributions can be made until April 15, 2021).

Backdoor Roth IRA - What There Is To Know iTrust Capital

#1 in Security Gemini Crypto - The Safest Place to Buy Crypto

The 3 Ways to Fund your iTrustCapital IRA - The #1 Crypto IRA .

Lower Your Retirement Costs - TSP - Official Site

For any crypto trader or investor, keeping track of the price of cryptocurrencies in the market takes effort and discipline. Most of all, it requires the assistance of the best app for cryptocurrency price alerts. CoinMarketAlert offers the best app for cryptocurrency price alerts with smart alerts that let you track multiple cryptocurrencies. On your dashboard, our crypto price alert app gives you the capacity to track a specific cryptocurrency, set the price alert for that cryptocurrency .

You have # active price alerts. We currently monitor #### cryptocurrencies for real-time customizable price alerts. Choose from many ways to receive alerts, such as our Telegram, Discord or Slack bots. Real-time price monitoring across ## exchanges, including Coinbase, Binance, Bittrex, BitMEX, Kraken and Bitfinex.

Set customizable alerts on important metrics within the Bitcoin, DeFi and wider Crypto ecosystem. In addition to price alerts, we detect exchanges listings, volume spikes, BTC & ETH wallet transactions, the BTC Mempool size, ETH gas prices, and other on-chain metrics. Key Features. * Price Alerts - Realtime, customizable price alerts for over 20,000 different cryptocurrencies across 30+ top crypto exchanges, including Coinbase Pro, Binance, Uniswap, PancakeSwap, BitMEX, FTX, Bittrex .

iTrustCapital Review: Fees Worth the Returns?

What is a cryptocurrency price alert? CoinCodex gives you the ability to set up cryptocurrency price alerts and receive notifications via email or the CoinCodex app. Instead of constantly monitoring cryptocurrency prices, you can simply set up alerts that will automatically let you know when important price levels are reached.

Funding an IRA with Crypto - Is it possible? iTrust Capital

Cryptocurrency Alerting - An App for Bitcoin & Crypto Alerts

*A Roth IRA gives investors a ‘pay now, save later’ tax advantage. You forego any possible tax deductions upfront for tax-free gains later. Final Thoughts. Many Traditional IRAs are funded from rollovers of employer plans and can be sizeable. Bear in mind you can always do a partial conversion to a Roth IRA and have both types of accounts.

Crypto Price Alert: JPMorgan Has Issued A Stark Ethereum NFT .

iTrustCapital's business model is fairly simple. They make it possible for users to add non-traditional investments (cryptocurrencies and precious metals) to their IRAs. Just like other IRAs, iTrustCapital's crypto IRAs offer tax benefits. Depending on whether you choose a Traditional or Roth IRA, your account will be either tax-deferred or tax-free.

iTrustCapital Reviews Read Customer Service Reviews of .

Frustrating long process for Roth conversion. For anyone reading this rating please note it is poor simply because of the frustratingly slow process itrustcapital has for doing a Roth backdoor conversion. They received my money to my traditional IRA 10 days ago and it took that long for the conversion to post to my Roth account.

Crypto+price+alerts News

iTrustCapital is the #1 Crypto IRA / 401k platform offering cryptocurrencies, gold and silver within your retirement accounts.

Bitcoin, ethereum and cryptocurrency prices are struggling after a terrible start to 2022 (even as the non-fungible token (NFT) craze rolls on). Subscribe now to Forbes' CryptoAsset & Blockchain .

You have # active price alerts. We currently monitor #### cryptocurrencies for real-time customizable price alerts. Choose from many ways to receive alerts, such as our Telegram, Discord or Slack bots. Real-time price monitoring across ## exchanges, including Coinbase, Binance, Bittrex, BitMEX, Kraken and Bitfinex.